While the former considers only variable costs, the latter takes into account both variable and fixed costs. You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. You need to calculate the contribution margin to understand whether your business can cover its fixed cost.

Operating Assumptions

Evangelina Petrakis, 21, was in high school when she posted on social media for fun — then realized a business opportunity. Accordingly, the net sales of Dobson Books Company during the previous year was $200,000. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

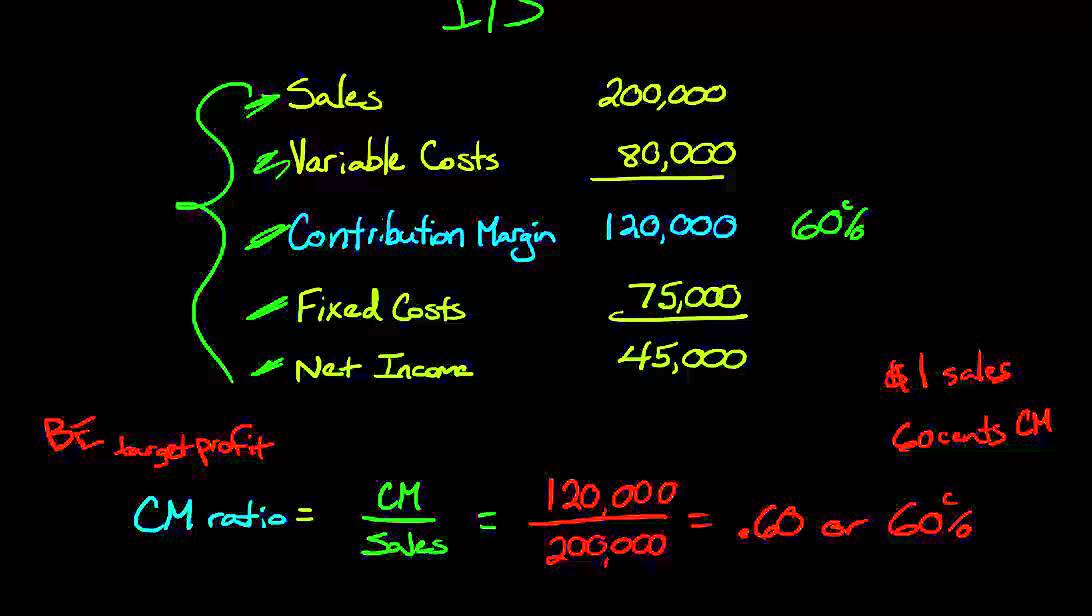

Contribution Margin Ratio:

Profit margin is calculated using all expenses that directly go into producing the product. The addition of $1 per item of variable cost lowered the contribution margin ratio by a whopping 10%. You can see how much costs can affect profits for a company, and why it is important to keep costs low. The CM ratio is a useful tool for managers when making decisions such as setting sales prices, selecting product lines, and managing costs. It is also used in break-even analysis and to measure operating leverage.

Total Variable Cost

- A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs.

- Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company.

- For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product.

To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. From this calculation, ABC Widgets learns that 70% of each product sale is available to contribute toward the $31,000 of total fixed expenses it needs to cover each month and also help achieve its profit target.

The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business realizes from the sale of goods or services.

Operating Profit or Loss

The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. For variable costs, the company pays $4 to manufacture each unit and $2 labor per unit. One of the important pieces current assets definition lists and formula 2023 of this break-even analysis is the contribution margin, also called dollar contribution per unit. Analysts calculate the contribution margin by first finding the variable cost per unit sold and subtracting it from the selling price per unit.

On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances. As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000. However, the contribution margin for selling 2000 packets of whole wheat bread would be as follows.

The contribution margin is given as a currency, while the ratio is presented as a percentage. Thus, to arrive at the net sales of your business, you need to use the following formula. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

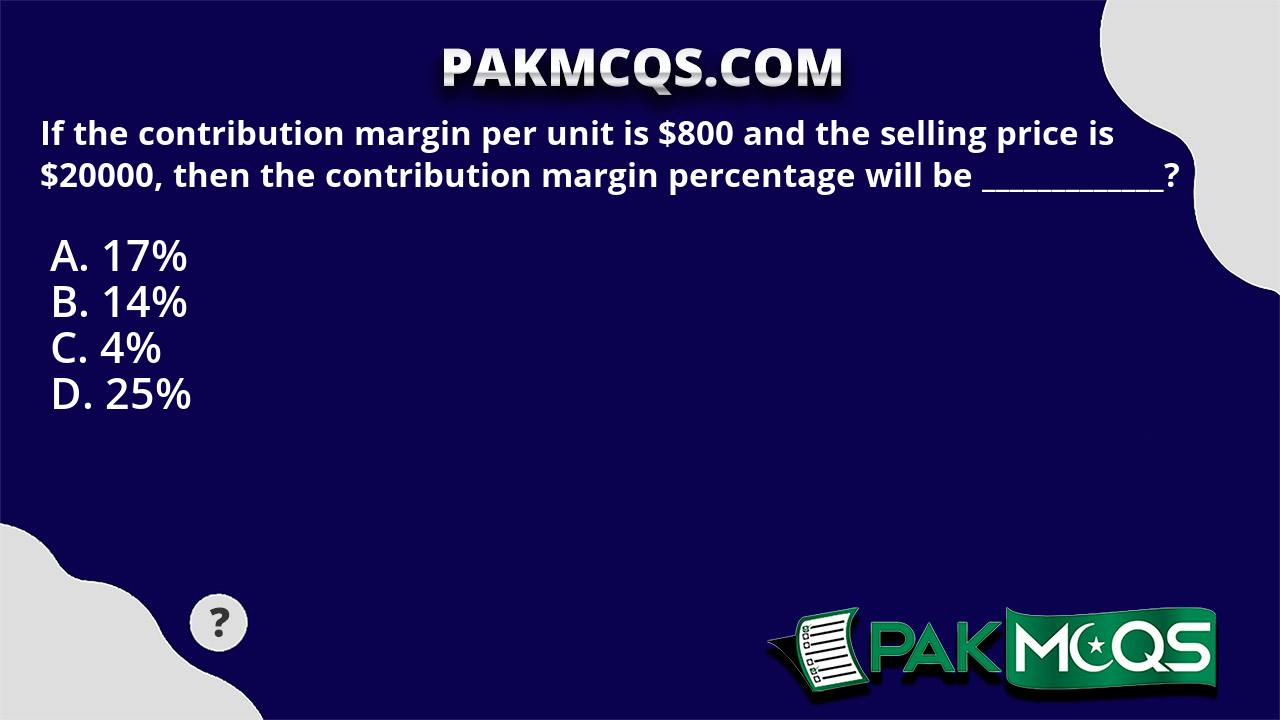

The contribution margin is a profitability metric that measures how selling a particular product affects a company’s operating income. It is calculated as the selling price per unit, minus the variable cost per unit. In other words, it signifies the ‘contribution’ each unit of a product makes to the company’s profits once the variable costs – costs that change in proportion to the volume of goods produced – have been covered. The contribution margin ratio is just one of many important financial metrics used for making better informed business decisions. The ratio can help businesses choose a pricing strategy that makes sure sales cover variable costs, with enough left over to contribute to both fixed expenses and profits. It can also be an invaluable tool for deciding which products may have the highest profitability, particularly when those products use equivalent resources.

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.